Your manual is waiting for you 🎉

Get W-8BEN Now61b082ccce61ef11782913b2

If you are a non-resident alien who receives income from U.S. sources, you may be familiar with the W-8BEN form. This form is a crucial document that helps the IRS (Internal Revenue Service) determine your tax status and eligibility for tax treaty benefits. In this article, we will delve into what the W-8BEN form is, its uses, how to fill it out, and who typically requests it.

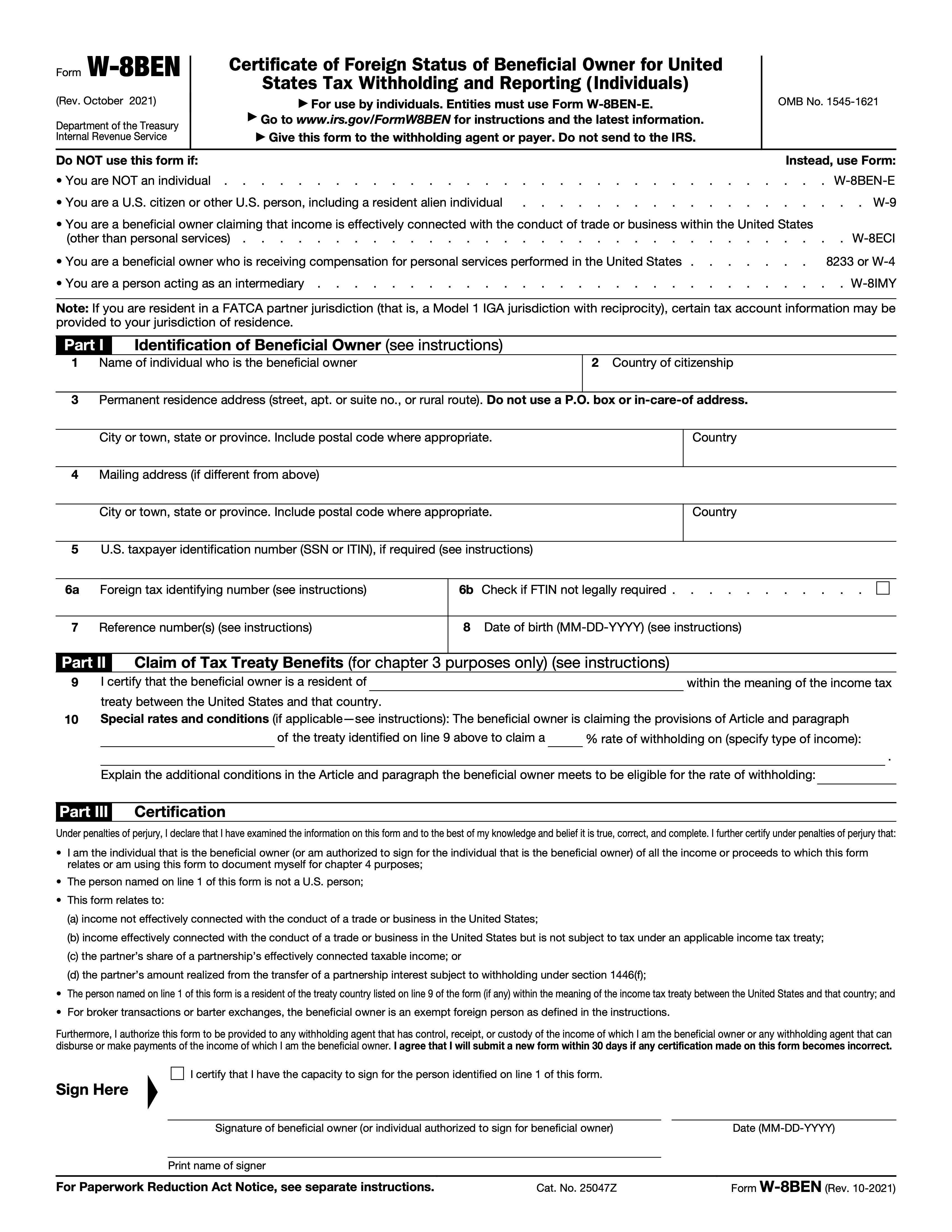

Form W-8BEN, also known as the "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)," is a tax form required by the U.S. government for foreign individuals who earn income in the United States. This form is used to declare one's foreign status and claim any applicable tax treaty benefits that may reduce or exempt withholding taxes on income earned in the U.S.

The primary purpose of the W-8BEN form is to establish your foreign status as a non-resident alien for tax purposes. By completing this form, you are certifying to the IRS that you are not a U.S. citizen or resident alien, and you are providing information about your country of residence for tax purposes. Additionally, the form allows you to claim any tax treaty benefits available between the U.S. and your country of residence, which may reduce the amount of tax withheld from your income.

Here are common situations when you might use the W-8BEN form:

Remember, it's important for individuals and entities to properly complete the W-8BEN form to claim tax treaty benefits or to certify their status as non-U.S. persons, thereby potentially reducing the tax withholding on their U.S. source income.

Filling out a W-8BEN form may seem daunting at first, but with the right guidance, it can be a straightforward process. Here are the steps to completing the form:

Remember to consult with a tax professional if you have any questions or concerns about completing the W-8BEN form accurately and timely.

The requester of a W-8BEN form is typically the U.S. withholding agent or financial institution that is paying you income subject to U.S. withholding tax. This could include banks, investment firms, employers, or other entities that make payments to non-resident aliens. The requester is required to collect the W-8BEN form from you to fulfill their reporting and withholding requirements under U.S. tax laws.

In some cases, the requester may request additional documentation or information to support the claim of foreign status and eligibility for treaty benefits. Also remember, you may use several ways to fill out this tax form. It is important to provide the requested information promptly to avoid any delays in receiving your income or potential tax implications.