Your manual is waiting for you 🎉

Get W-9 Now 65f013686d1834a70e07c82d

In the current era of digitization, the incorporation of artificial intelligence (AI) across various sectors has become the norm. This has significantly optimized procedures and made daunting and time-consuming tasks more straightforward. One such application of AI is in filling out tax-related forms like the W-9, which used to be an intimidating procedure for many, but not anymore. With AI-powered solutions, completing a W-9 online is now a faster, smoother, and more accurate process.

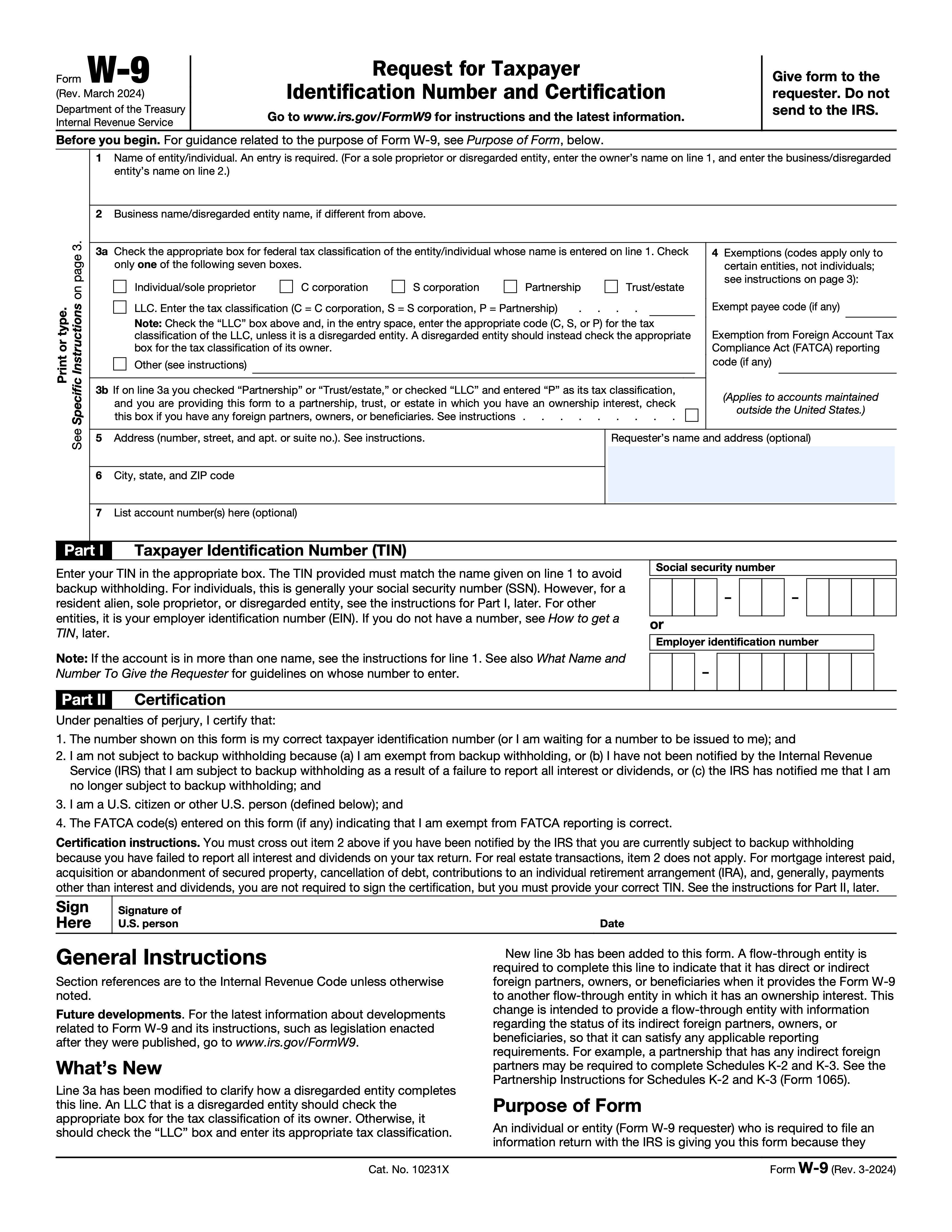

Before delving into how to fill out a W-9 form online using AI, it’s crucial to understand what this form is. The Internal Revenue Service (IRS) in the United States utilizes the W-9 form to obtain information about contractors, freelancers, or companies, mainly to track payment made to them. It also helps the IRS gather correct taxpayer identification numbers.

Previously, the process of filling out a W-9 form was manual, and it would take time and double-checking to ensure the precision of the provided information. However, with AI being incorporated into financial services, this task has been made far easier. Let's dig deeper into how to use AI-powered technology to fill out a W-9 form online, seamlessly and quickly.

Here's an easy guide on how to fill out a W-9 form online using AI Assistant helper:

One of the many advantages of filling out your W-9 form with an AI tool is the improved accuracy and ensuing validation. As you input your details, the AI Assistant system checks for any discrepancies, and if a mistake is found, it is immediately brought to your attention.

For instance, when filling out your taxpayer identification number, AI technology checks if the input number coincides with the standard IRS formatting. If the system identifies an error, it informs you instantly, therefore preventing any future inconveniences or penalties that could arise due to incorrect information.

Given the sensitivity of the information involved in tax forms, security is of paramount importance. Here’s where AI really excels. Advanced encryption algorithms are utilized to ensure that the data is kept securely. This makes filling out W-9s online not only fast but also safe and secure.

Thanks to advanced technology and AI capabilities, filling out a W-9 form online has gone from being a challenge to a painless task. This technology doesn't just simplify the process; it also adds a layer of precision, verification, and robust security. With AI Assistant, handling tax forms becomes quick and trustworthy.

Nowadays, with AI, we are stepping into a new era of document processing, guaranteeing precision and alacrity, making your tax filing experiences stress-free and efficient.